What Is Affordable Housing?

Affordable housing is frequently defined as housing that is affordable based on the income of a household’s members. Housing experts in the United States say housing is affordable if people living in the same household spend no more than 30% of total gross income on housing.

The reason for the 30% income guideline is this theoretically should leave the household enough money left to pay for other essentials. The other 70% is available to spend on food, clothing, health care, transportation, education, and savings.

Basically, the rule means that after paying for housing costs people should have enough money to pay for all the other necessities that make life livable and enjoyable. (Oh, and let’s not forget taxes, which will also need to be deducted from gross income.)

As you can see, that 70% really needs to stretch to cover a whole lot of living expenses!

So, in theory, the 30% spent on housing each month sounds like a nice budget rule. In reality, though, many households spend much more than 30% of their income on housing costs.

In some high-cost areas, people routinely spend 40%, 50% or more of their income for a place to live. For these people, their housing is not affordable, but decidedly unaffordable. These households may be forced to cut back on necessities or go into debt to pay for housing.

For these households, the idea of “saving for a rainy day” goes out the window, as many are living paycheck to paycheck.

A Visual Representation of Affordable Housing

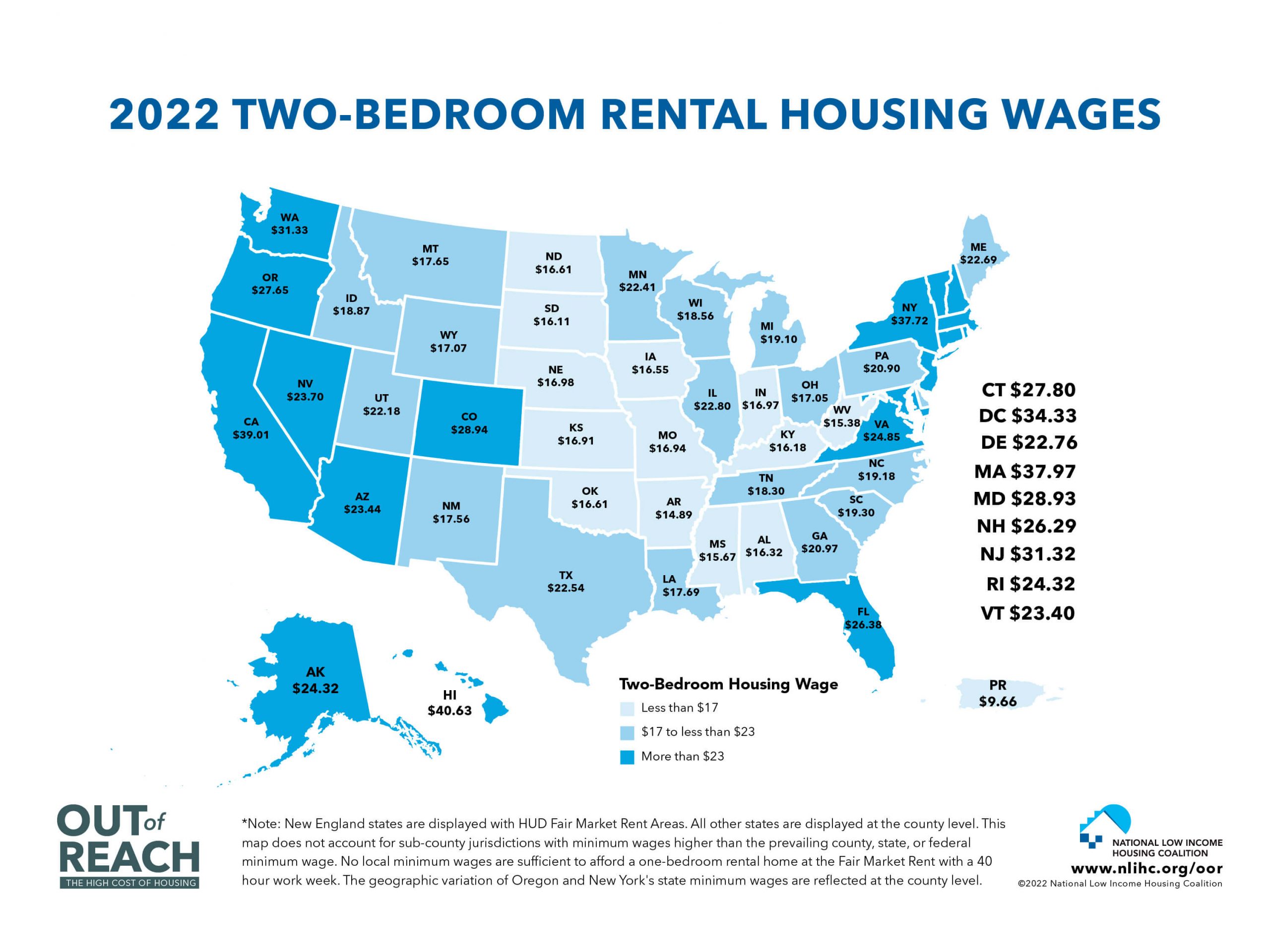

For over 30 years, the National Low Income Housing Coalition (NLIHC) has published their annual report, Out of Reach, documenting the gap between what people earn and the cost of housing.

They say a picture is worth a thousand words. So, let’s take a close look at one of the more startling visual representations of how unaffordable housing has become in the U.S. as shown in Out of Reach.

This map shows by state the hourly wage a full-time worker (40 hours a week, 52 weeks a year) must earn to afford the fair market rent for a two-bedroom home without paying more than 30% of their income.

Not too surprisingly, you need a high hourly wage in the expensive North East and West Coast just to afford a modest (not lavish, according to the NLIHC) two-bedroom home. You’ll need to earn $37.72 an hour in New York, $37.97 an hour in Massachusetts, and $39.01 in California.

Certainly, this is well out of reach for someone who is earning the federal minimum wage in the U.S., which as of 2022 is $7.25 an hour (the same amount it’s been since July 2009). With few exceptions, a couple each working full-time making minimum wage still couldn’t afford a two-bedroom home.

Some state minimum wages are much higher. The minimum wage in California, for example, is $14 an hour for employers with 25 employees or fewer and $15 for employers with 26 employees or more. Despite this, in many cases, it’s still not enough for a couple to afford a two-bedroom apartment without spending more than 30% of their income.

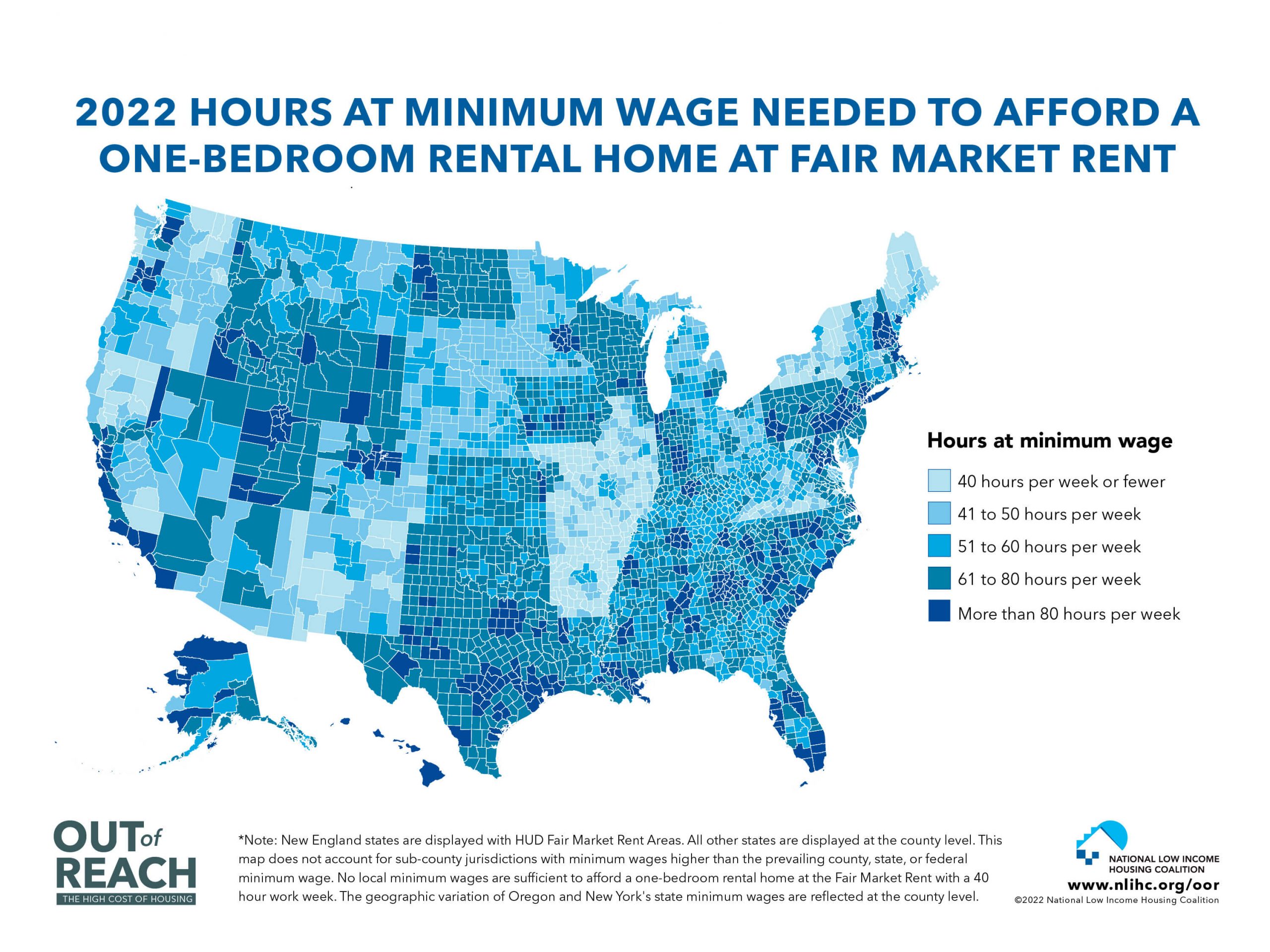

Let’s look at how many hours at minimum wage somebody would need to work to afford a one-bedroom home…

Affordable Housing and the “Housing Wage”

Are you shocked by how many areas of the country somebody making minimum wage would need to work 61 to 80 hours per week to afford a one-bedroom apartment? And what about those dark blue areas? Can you imagine working 80 hours or more per week?

You might be tempted to think that affordable housing is just a low income, minimum wage problem. However, that’s not the case. People in occupations that pay well above minimum wage struggle with housing costs, as this “housing wage” chart illustrates:

The Median Income Rule for Affordable Housing

Another affordable housing definition brings in the concept of affordability for the median income in a given area. This definition takes into consideration the fact that incomes can vary dramatically within districts of the same city.

Median household income for an area is the amount that acts as a dividing line. Half the households in the area will have an income over that amount, and half will have an income below. By establishing a median income for a given area, housing programs can then determine affordability guidelines for the area.

For example, housing lotteries run by government agencies often stipulate that people applying for an affordable housing unit must earn no more than a certain percentage of the area’s median household income.

Income requirements for a housing lottery might read something like these examples (paraphrased and adapted from the requirements listed on various affordable housing sites):

Income requirements example 1:

Forty percent of the units are for households earning up to $75,000 yearly (or 80% of the area’s median income). Sixty percent of the apartments are reserved for those earning between $25,000 and $60,000 a year. Depending on household income, monthly rents for the two-bedroom units range between $575 and $1,400.

Income requirements example 2:

To be eligible to live here, residents’ incomes must be less than 50% of the area median income (AMI). Twenty percent of the units will be set aside as workforce housing for teachers and first responders.

Income requirements example 3:

The new building has 118 new units of affordable housing. They range from studios to three-bedrooms for families earning between 60% and 130% of area median income. This is roughly $31,000 to $143,000. The community includes about 7,000 square feet of childcare, community, and retail spaces.

Where Can I Find Affordable Housing?

In the United States, you can find information about affordable housing in your area through your local housing authority. A housing authority is a government agency responsible for providing low or reduced rent housing to qualified residents.

The housing authority in your area administers programs funded through federal government agencies, such as the Department of Housing and Urban Development (HUD). Your area might have several different types of affordable housing programs. These might include rental assistance programs, Section 8 vouchers, public housing, housing lotteries, rental subsidies, rent control, and affordable home ownership programs.

You can also find affordable housing through nonprofit organizations. An example of this is Habitat for Humanity, a nonprofit that helps families and communities around the world build and repair homes.

Sharing As an Affordable Housing Option

Increasingly, people are looking beyond government programs to ensure they have affordable housing. Some people opt for “sharing options.” This means they reduce their housing expenses by sharing their household with others. These arrangements are different than your typical roommate situation.

For example, home sharing is when a “home provider” (often an elderly person) rents out a spare room in their home to a “home seeker.” In exchange for low rent, the home seeker will perform household chores for the home provider. This win-win situation allows the elderly home provider to live safely in their own home and provides an affordable rental for the home seeker.

Many home sharing agencies around the country help match home providers and home seekers. Our Home Sharing Guide gives you all the details on this affordable housing option.

Coliving is another type of shared housing. In a coliving arrangement, costs are kept down because you only rent a bedroom in a larger building. You and the other residents of the coliving building have access to shared kitchen spaces, bathrooms, and other communal spaces. These arrangements can significantly reduce your housing costs. For more information, check out our Complete Guide to Coliving.

If you’re interested in owning an affordable home, then a cohousing community might be a good option for you. Cohousing communities share resources, which enables everyone in the community to save money. For example, utilities and maintenance costs are often shared in a cohousing community. You’ll learn more about the benefits of this arrangement in our Cohousing Guide.

Alternative Housing Can Be Affordable, Too!

Here at Affordable Housing Tips, we’ve covered many alternative housing options. Some of these options aim to reduce the cost of housing by using cutting-edge manufacturing techniques and materials. For example, our Guide to 3D Printed Homes discusses how one manufacturer has “printed” an entire house for about $10,000!

Another popular trend is to repurpose materials and structures for use as dwellings. If this sounds exciting to you, then you’ll want to check out our Guide to Shipping Container Homes and our Guide to Converted School Buses.

The Bottom Line

Housing experts cite many reasons for the lack of affordable housing. Some feel government is to blame by implementing land use laws, rent control, zoning restrictions, and taxes that discourage development. Some blame the NIMBYs (short for “not in my backyard”) who petition against new housing developments in their neighborhoods.

Others say demographic shifts due to where jobs are located is the culprit in certain large cities. Some feel it’s simply a supply and demand problem. Build more housing and the prices will go down. And many note disparities in housing caused by redlining practices that have impacted the ability of minorities to buy homes.

No matter the reasons, the lack of affordable housing impacts the ability of people to achieve economic freedom and prosperity. Safe and decent housing is quite literally the foundation upon which people build their lives.

More “Alternative Housing” Articles

Skoolie Living: On the Road with Author Jordan O’Donnell

Skoolie Living: On the Road with Author Jordan O’Donnell

Interest in skoolie living has skyrocketed! O’Donnell gives us a glimpse of life on the road promoting his new novel. Read More

Our question and answer guide gives you all the details on this exciting affordable housing trend. Read More

Your Guide to Living in a Converted School Bus

Your Guide to Living in a Converted School Bus

Yearning to see the world, but low on funds? An affordable “skoolie” could help turn your travel dreams into a reality. Read More

What is a Shipping Container Home? Your Question and Answer Guide…

What is a Shipping Container Home? Your Question and Answer Guide…

A shipping container home is made from what the shipping industry calls “intermodal steel building units” (ISBUs) or what most people refer to as shipping … Read More

7 Hidden Costs of Building a Shipping Container Home

7 Hidden Costs of Building a Shipping Container Home

Don’t get caught off-guard by the cost of building your dream shipping container home. Check out these 7 hidden costs and prepare your budget in … Read More